Are you fearful of a market crash? Do you want to prevent what happened to your portfolio in 2008 and 2002? The simplest and fastest way to protect yourself from a market crash is to sell all of your stocks and wait – the only problem with this is that you are not making any returns on your cash, another more sophisticated way of buying “insurance” is to buy call options for negative ETFs or buying put options for stocks you own.

The first example could mean buying call options for such ETFs as “DOG”, “SH”, etc. (You can look these up later)

Buying put options will yield you much greater returns as these would take the maintenance cost of inverse ETF’s out of the equation. In fact, buying put options for positive ETF’s is probably an even better strategy since that would be putting the downward pressure from fund maintenance in your favor.

For example, if you owned 100 shares of Apple (Ticker AAPL), you could write a single put option for AAPL that expires next year with a strike price of $90 per share. That means if you’re holding Apple stock and it drops below $90 per share you won’t have to sell your stock but instead you would be gaining for every cent below $90 may fall by the time your option expires. That means you can also hold your shares without worrying until next year about how Apple stock price performs if you are in it for the long haul.

The only disadvantage to using options is that they expire, so the worst timing would be if they expire right before a huge market crash. To avoid this you can continue to buy put options as long as you hold shares – you need to pay for these options but doing so will insure you from the possibility of a even larger loss.

If you do the math many times this strategy will still yield more returns than holding cash but will offer a sort of insurance. The actual price today for a put option that expires in January for AAPL is $160. If Apple falls to $80 per share by that time, you will have made ($10 * 100 shares) – $160 investment, or $840 dollars. As you can see, you may also use this strategy to aggressively bet against the stock – something I do not subscribe to but something that would have paid off considerably in previous stock market pullbacks.

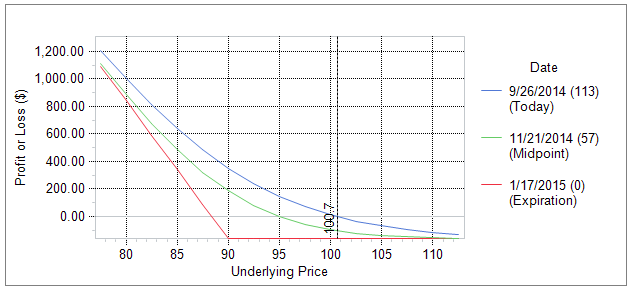

Below is a profit/loss chart for a $90 put option of Apple, as of September 27th. If we see a bear market or if Apple stock in particular falls, you will see the price for the option increase over time and you have the ability to sell your option up until it expires.

Keep in mind that historically the stock market will continue to rise, but given it’s 2013 leap and uncertainty about the world economy and prime interest rates it doesn’t hurt to keep your bases covered.